Have You Ever Tried to Sell a Diamond?

By Edward Jay Epstein

The diamond invention—the creation of the idea that diamonds are rare and valuable, and are essential signs of esteem—is a relatively recent development in the history of the diamond trade. Until the late nineteenth century, diamonds were found only in a few riverbeds in

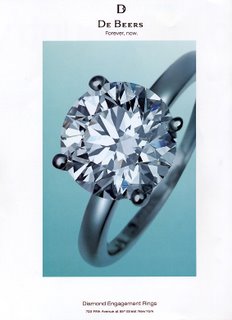

The major investors in the diamond mines realized that they had no alternative but to merge their interests into a single entity that would be powerful enough to control production and perpetuate the illusion of scarcity of diamonds. The instrument they created, in 1888, was called De Beers Consolidated Mines, Ltd., incorporated in

De Beers proved to be the most successful cartel arrangement in the annals of modern commerce. While other commodities, such as gold, silver, copper, rubber, and grains, fluctuated wildly in response to economic conditions, diamonds have continued, with few exceptions, to advance upward in price every year since the Depression. Indeed, the cartel seemed so superbly in control of prices -- and unassailable -- that, in the late 1970s, even speculators began buying diamonds as a guard against the vagaries of inflation and recession.

The diamond invention is far more than a monopoly for fixing diamond prices; it is a mechanism for converting tiny crystals of carbon into universally recognized tokens of wealth, power, and romance. To achieve this goal, De Beers had to control demand as well as supply. Both women and men had to be made to perceive diamonds not as marketable precious stones but as an inseparable part of courtship and married life. To stabilize the market, De Beers had to endow these stones with a sentiment that would inhibit the public from ever reselling them. The illusion had to be created that diamonds were forever -- "forever" in the sense that they should never be resold.

In September of 1938, Harry Oppenheimer, son of the founder of De Beers and then twenty-nine, traveled from

In

Oppenheimer suggested to Lauck that his agency prepare a plan for creating a new image for diamonds among Americans. He assured Lauck that De Beers had not called on any other American advertising agency with this proposal, and that if the plan met with his father's approval, N. W. Ayer would be the exclusive agents for the placement of newspaper and radio advertisements in the

In their subsequent investigation of the American diamond market, the staff of N. W. Ayer found that since the end of World War I, in 1919, the total amount of diamonds sold in America, measured in carats, had declined by 50 percent; at the same time, the quality of the diamonds, measured in dollar value, had declined by nearly 100 percent. An Ayer memo concluded that the depressed state of the market for diamonds was "the result of the economy, changes in social attitudes and the promotion of competitive luxuries."

Although it could do little about the state of the economy, N. W. Ayer suggested that through a well-orchestrated advertising and public-relations campaign it could have a significant impact on the "social attitudes of the public at large and thereby channel American spending toward larger and more expensive diamonds instead of "competitive luxuries." Specifically, the Ayer study stressed the need to strengthen the association in the public's mind of diamonds with romance. Since "young men buy over 90% of all engagement rings" it would be crucial to inculcate in them the idea that diamonds were a gift of love: the larger and finer the diamond, the greater the expression of love. Similarly, young women had to be encouraged to view diamonds as an integral part of any romantic courtship.

Since the Ayer plan to romanticize diamonds required subtly altering the public's picture of the way a man courts -- and wins -- a woman, the advertising agency strongly suggested exploiting the relatively new medium of motion pictures. Movie idols, the paragons of romance for the mass audience, would be given diamonds to use as their symbols of indestructible love. In addition, the agency suggested offering stories and society photographs to selected magazines and newspapers which would reinforce the link between diamonds and romance. Stories would stress the size of diamonds that celebrities presented to their loved ones, and photographs would conspicuously show the glittering stone on the hand of a well-known woman. Fashion designers would talk on radio programs about the "trend towards diamonds" that Ayer planned to start. The Ayer plan also envisioned using the British royal family to help foster the romantic allure of diamonds. An Ayer memo said, "Since Great Britain has such an important interest in the diamond industry, the royal couple could be of tremendous assistance to this British industry by wearing diamonds rather than other jewels." Queen Elizabeth later went on a well-publicized trip to several South African diamond mines, and she accepted a diamond from Oppenheimer.

In addition to putting these plans into action, N. W. Ayer placed a series of lush four-color advertisements in magazines that were presumed to mold elite opinion, featuring reproductions of famous paintings by such artists as Picasso, Derain, Dali, and Dufy. The advertisements were intended to convey the idea that diamonds, like paintings, were unique works of art. Full article

THE

by G. Edward Griffin 2006 September 8

Alex Jones is one of my favorite guerilla journalists. He goes where the timid will never be seen. And he is in a hurry. He shoots from the hip, which means that once in a while he may not get the facts entirely right; but, most of the time, he hits the bull’s-eye with his first shot. He is loud. He is crude. And he has done more to awaken the sleeping masses to the truth than anyone else on the scene today. I really like Alex Jones. So it is with great misgivings that I venture to say anything negative about him; but, in the case of the substance of this analysis, I have no choice because important strategic and ideological principles are at stake.

On June 19, 2006, Alex interviewed Greg Palast on his radio show. Greg is author of Big Oil and the Armed Madhouse. It is an excellent interview because it exposes one of the greatest myths of our time. The myth is that the

But the plot thickens. About a third into the interview, we learn that Palast visited Hugo Chavez in

I was dumbfounded. This was essentially the same as George Bush saying: “You are either with us or you are with the terrorists.” But this time, it was: “Either you are with Chavez or you are with Bush.” Once again, we are being herded into a two-chute coral. As usual, we are presented with two variations of collectivism. We are asked to choose either the Nazi model or the Soviet model. If we don’t like the Nazi model in the

I don’t know if Jones or Palast have thought this all the way through or if they are even aware of the deeper conflict between collectivism and individualism. Perhaps they were just so filled with disgust for Bush and Company that they were in no mood for analysis. However, since I am recommending that you take the time to listen to this important interview, I feel obligated to caution you about this false choice.

http://video.google.com/videoplay?docid=-3641043830777908106&q=911

No comments:

Post a Comment